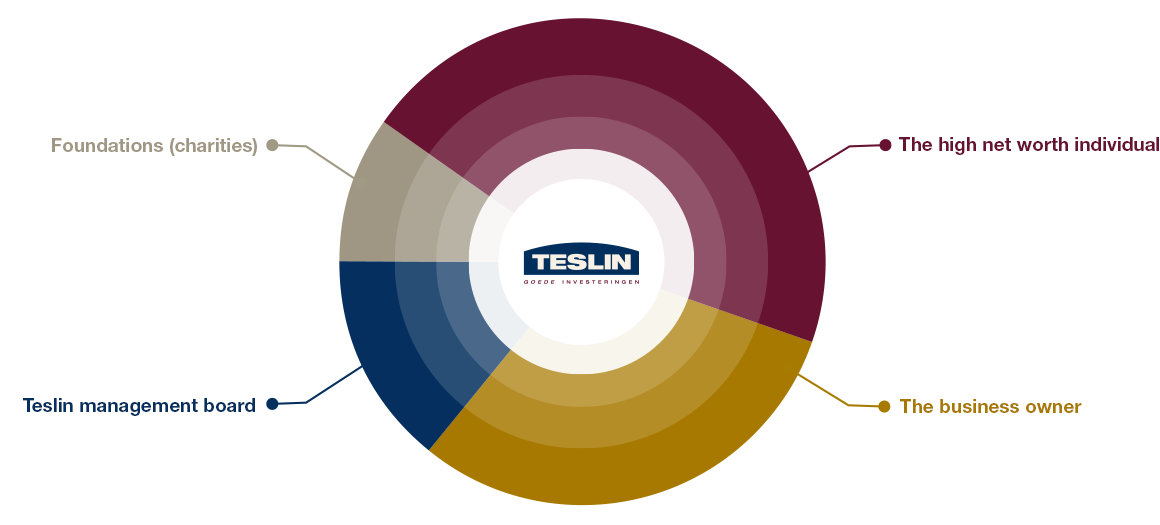

Whether they are business owners, high net worth individuals and families, or (charitable) foundations, investors at Teslin have something in common: they wish to invest part of their capital for the long term for a good return, in recognisable companies with comprehensible strategies and products / services. They value personal contact with the Teslin management board and our fund managers, and enjoy seeing each other regularly at meetings and company visits.

The high net worth individual

"At Teslin, we do not invest in complicated or exotic investment products, but in companies we understand. As an investor, you’ll feel like a co-owner of these companies. Our management board and fund managers know what they’re doing. We ensure that we’re always abreast of the latest developments. The Teslin management board also invests in its own funds. That breeds confidence."

High net worth individuals and families:

|

The business owner

“Teslin speaks the language of business owners and, as an engaged entrepreneurial shareholder, brings added value to the companies it invests in. I also like to invest in companies that I know, while the specialists do the ‘real work’. Teslin values our opinion: we regularly go on company visits and speak to the fund manager. It’s interesting to connect with other investors in this way.”

Business owners:

|

Teslin management board

"We make substantial investments in our own funds, and so bring our vision of being an engaged shareholder to life in more than one way. This gives other investors futher comfort that we will act in their interests. They are our interests too, after all.”

The Teslin management board:

|

Foundations (charities)

"For us, Teslin offers a great combination of responsible investing in equities and land. We share Teslin’s philosophy and vision, which they also demonstrably put into practice. This is important for us in terms of our corporate social responsibility and accountability.”

Foundations (charities):

|

Would you too like to invest with Teslin?

Within the scope of our investment philosophy of long-term sustainable value creation, our funds Gerlin Participaties, Midlin, Teslin Participaties and Rhoon, Pendrecht & Cortgene each have their own distinct features. We would like to ask you a few questions that can help you make a decision.